Account Funding

Instantly fund an account anytime, anywhere

Introduction

Fund enables Platforms to allow their end customers to fund their account using crypto or stablecoins as the rail. You can configure your setup so that deposits are automatically converted to fiat, allowing platforms to instantly recognize a credit to the customer's balance. Or, assets can remain in the deposited crypto/stablecoin asset. This is an alternative funding mechanism that can live side-by-side next to card, wire, ACH, etc.

Use Cases

- Investment platforms: Platforms that allow other businesses to fundraise or ones that allow their end customers to contribute to investment funds can leverage the Account Funding product to provide an additional funding option.

- Trading account funding: CFD or equity trading platforms can offer an alternative funding method that sits side-by-side next to traditional methods such as card, bank transfer, etc.

- Neobanks and digital wallets: Money apps can increase assets on the platform, thus increasing overall engagement by activating this product.

- Any platform that requires users to fund their account: This new funding method is applicable to any platform with end retail customers who need to fund their account in order to trade, invest, or subsequently purchase a good or service.

Key Features

- Available anytime: 24/7/365 instant account funding

- Lightning fast: Transactions on-chain settle quickly, allowing for instant account balance updates

- Eliminate chargebacks: Irreversible transactions remove chargeback risk

- Globally accessible: Onboard customers and no more complexity with managing many local fiat payment rails

- Cheaper: Transfer fees are cheaper than ACH, Card, Wire, and Swift transactions

Integration Details

Setup

It's important to note that in order to use the Account Funding product, the End Customer must be onboarded to zerohash. This can be done in 1 of 3 ways:

- API (Reliance): approved Platforms use a KYC solution of their own and pass zerohash the results of each verification via API.

- API (KYC as a Service) [coming soon and individually based on compliance approval]: Platforms can use the zerohash KYC product, while owning the front end themselves.

- SDK (KYC as a Service): Platforms can use the zerohash KYC product, while leveraging the zerohash front end SDK.

You can then couple your selected onboarding method with 1 of 2 Fund options:

- API: leverage your own front end, using zerohash's REST API on the back end.

- SDK: embed zerohash's front end SDK.

Configurations

After you've chosen your setup, you can make some decisions on how your integration is configured:

Ledgering Options

Option 1: After the crypto or stablecoin is converted to fiat, the USD is automatically transferred to the Platform on the zerohash ledger. So the flow of funds is:

| Movement Type | Participant | Asset | Type |

|---|---|---|---|

| Deposit | End Customer | USDC (for example) | Credit |

| Trade Settlement (automatic and immediately after the Deposit) | End Customer | USDC | Debit |

| Trade Settlement | End Customer | USD (for example) | Credit |

| Transfer | End Customer | USD | Debit |

| Transfer | Platform | USD | Credit |

Option 2: After the crypto or stablecoin is converted to fiat, the USD is not automatically transferred to the Platform on the zerohash ledger and instead sits in the End Customer's account (not recommended for Platform's using the Account Funding SDK). From there, the platform can initiate a fiat withdraw directly from the End Customer's account. So the flow of funds is:

| Movement Type | Participant | Asset | Type |

|---|---|---|---|

| Deposit | End Customer | USDC | Credit |

| Trade Settlement (automatic and immediately after the Deposit) | End Customer | USDC | Debit |

| Trade Settlement | End Customer | USD | Credit |

Fees

Option 1: Platform incurs the fee. In this case, the End Customer will not be charged any fee upon conversion (issuer fees may still apply).

Option 2: End Customer incurs the fee. This option allows the Platform to pass along their costs. The fee will be taken upon the conversion

Maximum and Minimum Deposits

- Similar to traditional funding methods, Platforms have the ability to tell zerohash the minimum and maximum deposit amounts to enforce. On the SDK, these values will be presented on the front end for the End Customer's awareness.

- By default, each platform will inherit a maximum threshold of $250,000 per deposit and $1 minimum threshold.

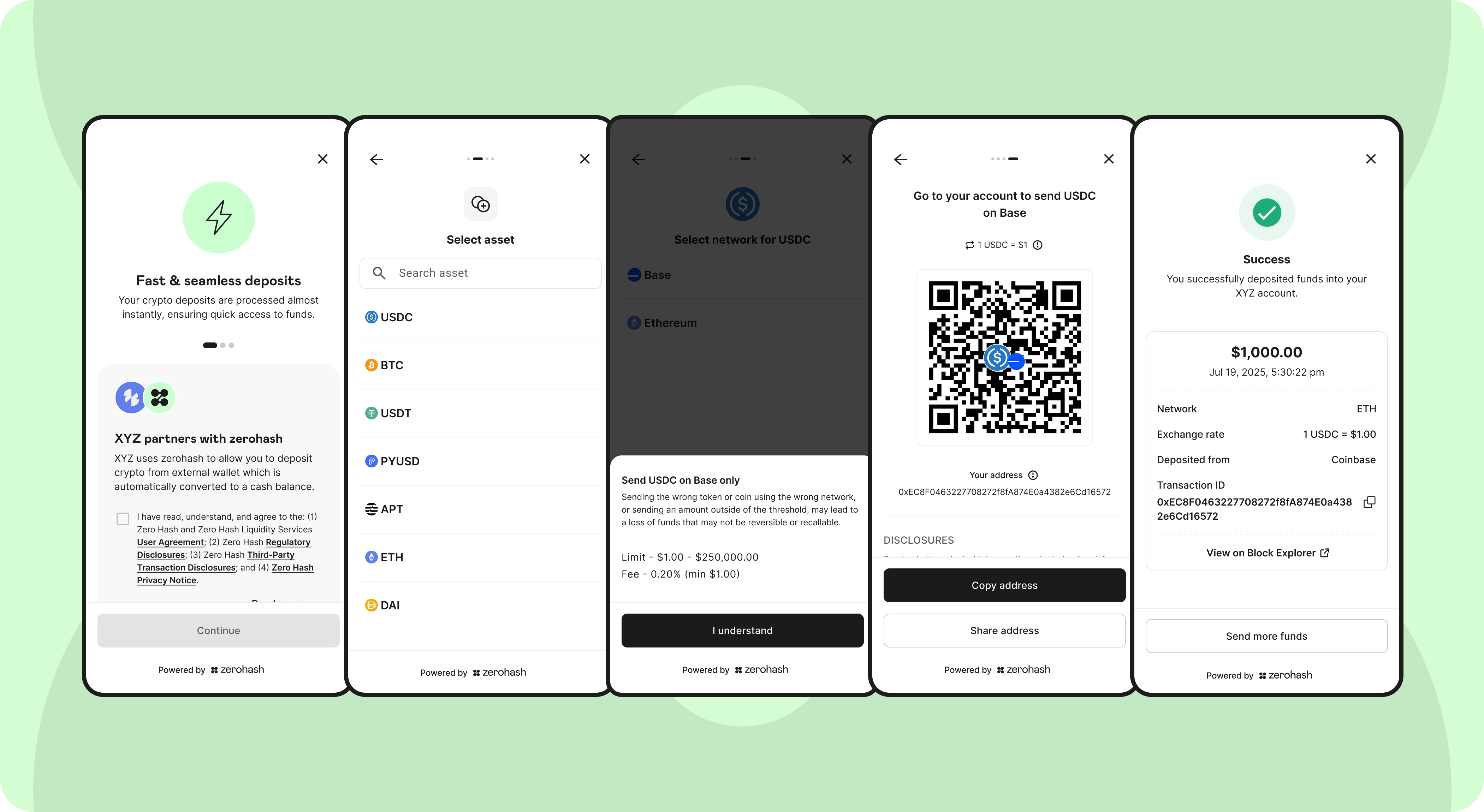

Company logo and brand name (SDK only)

In order to enable maximum customization and to match the look and feel of your native application, you can customize:

- the logo that's displayed to the customer; and,

- company's brand name in text; and,

- color scheme.

Example:

Email Receipts

zerohash requires that each End Customer receives an email receipt upon a crypto or stablecoin deposit. zerohash has the ability to trigger these ourselves. This is the recommended path for the quickest possible integration.

Supported Assets

Here is the list of supported assets for this product (also can be retrieved via GET /assets where fund_enabled = true

| Asset Symbol | Asset Name |

|---|---|

| APT | Aptos |

| ARB.ARBITRUM | Arbitrum |

| ATOM | Cosmos Hub |

| AVAX | Avalanche |

| BNB | BNB |

| BONK.SOL | Bonk (Solana) |

| BTC | Bitcoin |

| CC | Canton Coin |

| CELO | CELO |

| CRV.ETH | Curve DAO Token |

| DAI | MakerDAO USD Stablecoin |

| DOT | Polkadot |

| ETH | Ether |

| ETH.ARBITRUM | Ether (Arbitrum) |

| ETH.BASE | Ether (Base) |

| ETH.OPTIMISM | Ether (OP Mainnet) |

| ETH.WORLDCHAIN | Ether (Worldchain) |

| ETH.ZKSYNC | Ether (zkSync Era) |

| FIL | Filecoin |

| GALA.ETH | Gala (Ethereum) |

| GRT | Graph Token |

| LDO.ETH | Lido DAO Token |

| LINK | ChainLink |

| MON | Monad |

| NEAR | NEAR Protocol |

| OP.OPTIMISM | Optimism |

| PENGU.SOL | Pudgy Penguins |

| PNUT.SOL | Peanut The Squirrel (Solana) |

| PUMP.SOL | Pump.fun |

| PYUSD.ETH | PayPal USD (Ethereum) |

| PYUSD.SOL | PayPal USD (Solana) |

| RLUSD.ETH | Ripple USD (Ethereum) |

| RLUSD.XRP | Ripple USD ( Ripple ) |

| SAND | The Sandbox |

| SEI | SEI |

| SOL | Solana |

| SUI | SUI |

| TIA | Celestia |

| TON | Toncoin |

| TRUMP.SOL | Official Trump |

| TRX | Tron |

| UNI | Uniswap |

| USDC.ETH | USDC Coin (Ethereum)USDC Coin (Arbitrum) |

| USDC.ALGO | USDC Coin (Algorand) |

| USDC.APT | USDC Coin (Aptos) |

| USDC.ARBITRUM | USDC Coin (Arbitrum) |

| USDC.AVAX | USDC Coin (Avalanche) |

| USDC.BASE | USDC Coin (Base) |

| USDC.BSC | USDC Coin (Binance Smart Chain) |

| USDC.CELO | USDC Coin (Celo) |

| USDC.MONAD | USDC Coin (Monad) |

| USDC.OPTIMISM | USDC Coin (Optimism) |

| USDC.POLYGON | USDC Coin (Polygon) |

| USDC.SEI | USDC Coin (SEI) |

| USDC.SOL | USDC Coin (Solana) |

| USDC.SUI | USDC Coin (SUI) |

| USDC.WORLDCHAIN | USDC Coin (Worldchain) |

| USDC.ZKSYNC | USDC Coin (zkSync Era) |

| USDT | Tether (Ethereum) |

| USDT.ARBITRUM | Tether (Arbitrum) |

| USDT.AVAX | Tether (Avalanche) |

| USDT.BSC | Tether (Binance Smart Chain) |

| USDT.CELO | Tether (Celo) |

| USDT.OPTIMISM | Tether (Optimism) |

| USDT.POLYGON | Tether (Polygon) |

| USDT.SOL | Tether (Solana) |

| USDT.TRX | Tether (Tron) |

| USDT.XPL | Tether (Plasma) |

| WIF.SOL | Dog Wif Hat (Solana) |

| WLD.WORLDCHAIN | Worldcoin (World Chain) |

| XPL | Plasma |

| XRP | XRP |

Webhooks

We offer webhooks specific to this product. See details here: Fund Webhook

Platform Settlement

General

Platforms will receive a once a day batch fiat settlement. Settlement schedule:

| Session | Start | End | Expected Settlement Time* |

|---|---|---|---|

| Monday | Monday 9:00a EST | Tuesday 8:59:59a EST | Tuesday EOD |

| Tuesday | Tuesday 9:00a EST | Wednesday 8:59:59a EST | Wednesday EOD |

| Wednesday | Wednesday 9:00a EST | Thursday 8:59:59a EST | Thursday EOD |

| Thursday | Thursday 9:00a EST | Friday 8:59:59a EST | Friday EOD |

| Friday | Friday 9:00a EST | Monday 8:59:59a EST | Monday EOD |

During US holidays, Platforms should expect their settlements to arrive by EOD on the next business day. For example, for the August 30th 2024 session, the settlement will arrive by Tuesday EOD (because Monday was Labor Day)

Updated about 2 months ago